Tax Information

*

Tax Information *

Please note

This page is not intended to be tax advice and is better viewed from a desktop

Resources

Use this tool to check your refund. Your refund status will appear around:

24 hours after you e-file a current-year return

3 or 4 days after you e-file a prior-year return

4 weeks after you file a paper return

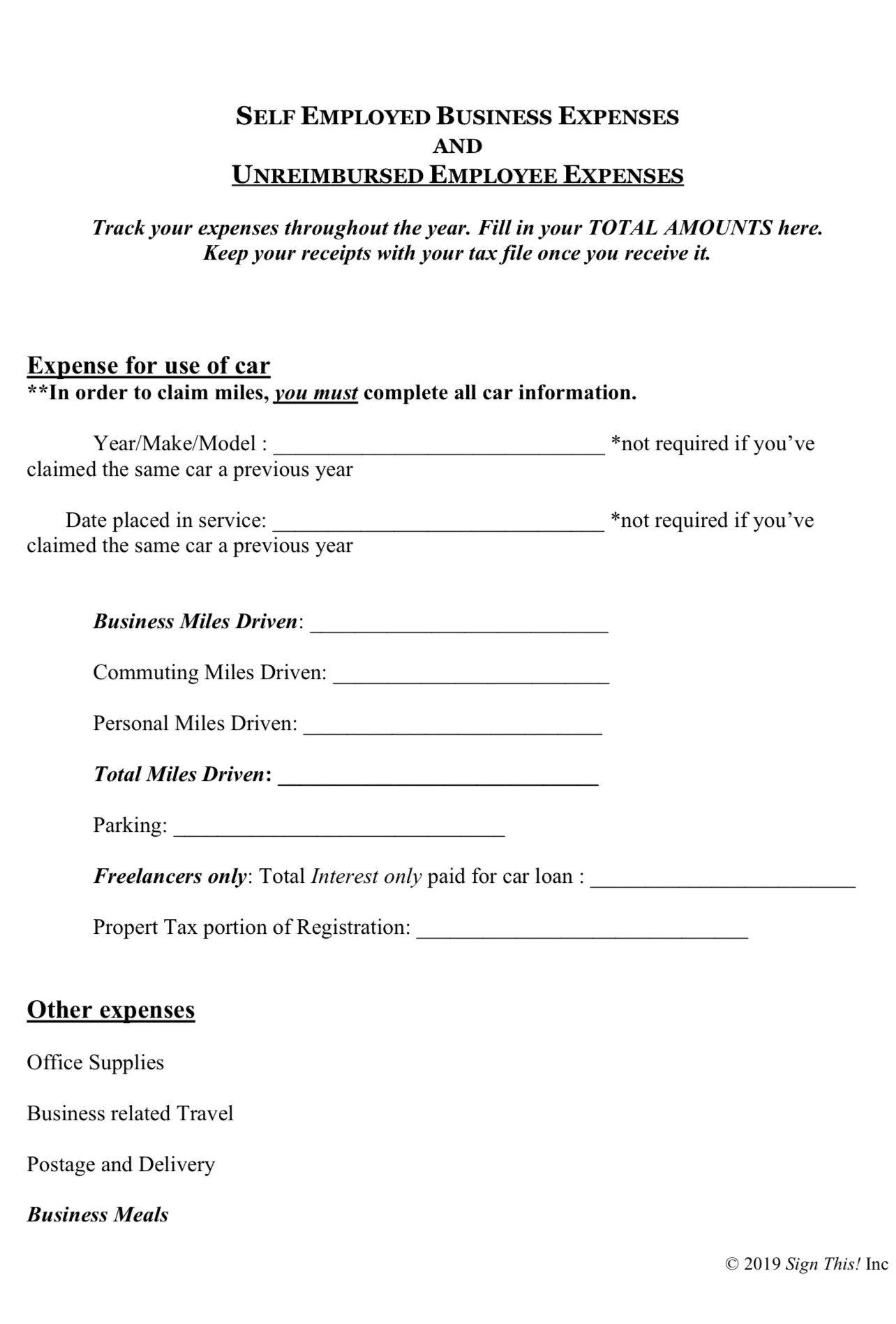

Calendar information for filing with us.

We appreciate you checking in.

In order to be effective and as accurate as possible, we are unable to accept additional tax clients at this time.

Contact information is for a business operating within business hours. Please allow time for a response, holidays, and weekends.

Please do not text documents or sensitive tax information.

When does filing season begin?

Employers and paying entities must send out wage and payment reporting forms by Jan 31. For this reason, although the IRS begins accepting electronically filed returns before this, our office begins submitting electronic tax returns on the first week of February.

Do you have Tax Questions or Questions about your return?

It’s best to Schedule an Appointment or Send an Email.

Email and scheduling phone/video appointments work best to discuss tax topics.

Additionally some questions are best addressed having reviewed your return or additional resources.

Please do not text tax questions or sensitive tax information.

Closed for the Holiday Season

The tax office is closed for end of year books and for the winter holidays.

Communications may be delayed at this time. We suggest waiting for the filing season to begin. See below for more information.